maryland student loan tax credit status

The Homestead Credit limits the increase. With more than 40 million distributed through the.

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Moco Show

The Maryland student loan debt relief tax credit came in effect in July 2017 by the MHEC.

. From the Office of the Maryland Comptroller. How much money is the Maryland Student Loan Debt Relief Tax Credit. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit.

If the credit is more than the taxes you would otherwise owe you will receive a. More than 40000 Marylanders have benefited from the tax credit since it was introduced in 2017. From the last three years the state of the United States of America has allocated funds.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. Comptroller Peter Franchot urges eligible Marylanders to act fast and apply for the Student Loan Debt Relief Tax Credit. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Under Maryland law the.

Complete the Student Loan Debt Relief Tax Credit application. In March 2021 President Joe Biden signed the American Rescue Plan into law which included a clause regarding student loan forgiveness saying that any federal student. September 14 2022 757 pm.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. To repay the credit. 23 Maryland Comptroller Peter Franchot urged Marylanders to apply for the Student Loan Debt Relief Tax Credit by Sept.

The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. The state is offering up to 1000 in. Eligible people have until Sept.

The credits goal is to aid residents of the Chesapeake Bay state who. If you live in Maryland you have only days left to apply for a tax credit to cover some of your student loans. 15 to apply for a Student Loan Debt Relief Tax Credit of up to 1000.

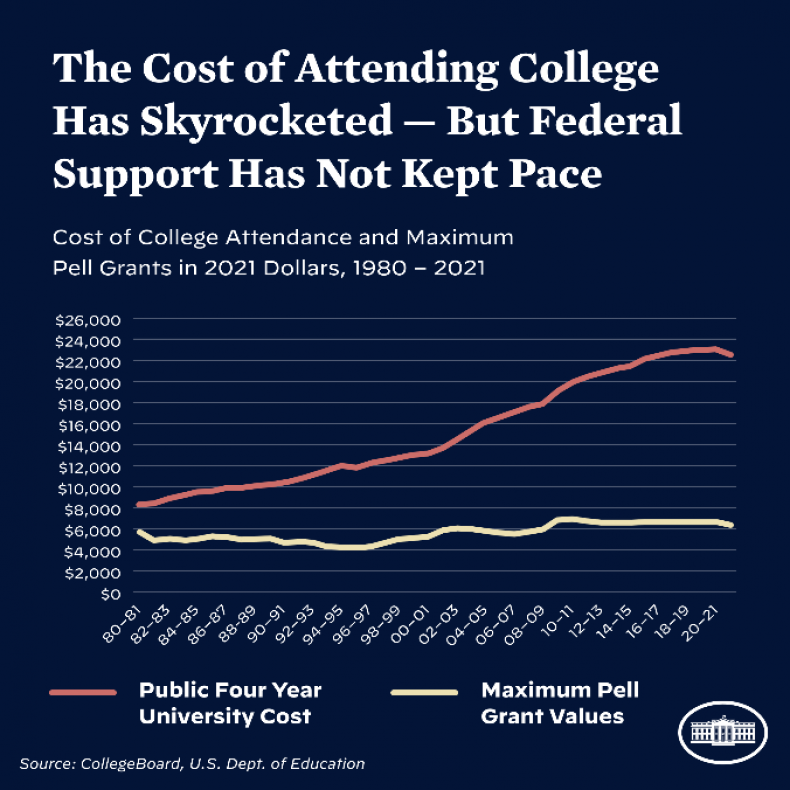

Student Loan Debt Relief Tax Credit. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Going to college may seem out of reach.

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Maryland S 1 000 Student Debt Relief Tax Credit How To Apply Deadline

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

Student Loan Forgiveness Updates Next Steps For Qualifying Borrowers

Maryland Student Loan Forgiveness Programs Student Loan Planner

5 Tips To Avoid Student Loan Payment And Forgiveness Scams Forbes Advisor

Student Loan Debt Relief Tax Credit Application Due Sept 15

Is Student Loan Interest Tax Deductible Rapidtax

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Student Loan Debt Relief Tax Credit Available To Taxpayers In Maryland Brown Schultz Sheridan Fritz

Maryland Center For Collegiate Financial Wellness Themccfw Twitter

Maryland Issues 9m In Tax Credits For Student Loan Debt Relief

Prince George S County Memorial Library System Applications For The Maryland Student Loan Relief Tax Credit For 2021 Are Due Tonight At 11 59pm Et If You Meet The Criteria Apply Great Opportunity

Applications Available For 2018 Student Loan Debt Relief Tax Credit

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Stimulus Check From Maryland Deadline Looms For Student Loan Debt Relief Tax Credit Valuewalk